draft kings 1099|What are the 1099 : Bacolod The best place to play daily fantasy sports for cash prizes. Make your first deposit! Huge Collection of Free Slots. At Slots Temple we’ve got all the top-notch free slots from America’s favorite developers so you can get the low down on everything from classic Vegas slots to bleeding-edge video slots with 5 reels and more.. Guide to Playing Free Slot Games at Slots Temple. The Slots Temple team is committed to providing players .

draft kings 1099,If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you can access the information directly from the Financial Center. You can expect to receive your tax .If you have greater than $600 of net earnings during a calendar year, you .

What are the 1099The best place to play daily fantasy sports for cash prizes. Make your first deposit!

If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings .(US) Am I taxed on my DraftKings withdrawals? (US) What are the 1099-Misc reporting thresholds for DraftKings Daily Fantasy Sports, Reignmakers, and Pick6 winnings? (US) . What kind of 1099 will you receive? You’ll likely get a 1099-MISC, which reports miscellaneous income. However, if you received your payouts from third-party .The best place to play daily fantasy sports for cash prizes. Make your first deposit!

The best place to play daily fantasy sports for cash prizes. Make your first deposit!

If you need help locating your DraftKings Tax Form 1099, we have a handy guide to show you where it is and why and how to fill yours in. If in any calendar year your winnings total over $600, DraftKings will issue you a Form 1099-MISC. This form is essentially a record of your earnings from .

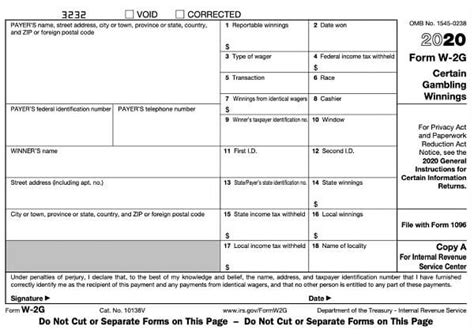

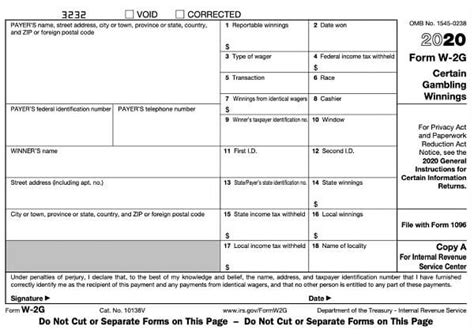

You can enter the amount from your 1099-MISC in the gambling winnings section. It will first ask you if you received a W-2G for your winnings. After you answer . Understanding Taxes on Winnings on DraftKings. All winnings from sports betting are subject to federal and state taxes. It’s crucial for players to report and pay . All winnings from sports betting are subject to federal and state taxes. It’s crucial for players to report and pay any due taxes. For winnings exceeding $600 in a year, DraftKings issues a 1099 form. This form reports total winnings for tax purposes. Locate these documents in the “Account” section of your DraftKings account.

draft kings 1099To ensure that DraftKings has the correct information for your tax forms, please visit the DraftKings Tax ID form to confirm or update your details.. Note: Fantasy app customers can update their IRS Form W-9 via desktop, laptop, or mobile web.I never received 1099 from DK or FD on my earnings (not over $600 individually), but I withdrew over $600 over the course of the year, net earnings from both, and received a 1099 from PayPal. . if I don’t receive a tax form from draft kings , then do I not have to report it ? I am worried and would like to put money aside now but again , I .Online sports betting and daily fantasy sports are distinct products and regulated as such. Betting on the DraftKings Sportsbook is currently only available in certain states. To find out which states, check out our guide to where sports betting is legal. If you live in a state where online sports betting is not permitted, you can sign up via .

The 1099 tax forms report your winnings to the taxing authorities and let you know the amount you must report on your tax return taxes. Even if you don’t receive a Form 1099, you must report the gambling income on your federal and state income tax returns. This includes the gambling income under the $600 reporting limit for the Form 1099-Misc.The only place I see where a 1099-MISC is applicable is Small Business/ Self employed which is not what my DRAFTKINGS form is from. Please advise as to where I input this other income that is not considered gambling however it was gambling winnings

draft kings 1099 What are the 1099 Draftkings Reignmakers. For Draftkings Reignmakers "winnings" they send you a 1099 Misc. Entering that # in TurboTax in the "other" income section (where it belongs) doesn't give you an option to select gambling losses to offset the "winnings". There has to be a way to deduct the cost of the contests, otherwise I lost money on the .Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.If you receive your winnings through PayPal, the .

draft kings 1099|What are the 1099

PH0 · Where can I find my DraftKings tax forms / documents (1099/ W

PH1 · Where can I find my DraftKings tax forms / documents (1099/ W

PH2 · What are the 1099

PH3 · Understanding Your DraftKings Tax Withholding: Key Strategies and Rul

PH4 · Understanding Your DraftKings Tax Withholding: Key Strategies

PH5 · Tax FAQs – DraftKings Help Center (US)

PH6 · Statements, Taxes and Documents on DraftKings – Overview

PH7 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH8 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH9 · Solved: Draftkings Reignmakers

PH10 · DraftKings Tax Form 1099

PH11 · DraftKings